webnf.ru

Recently Added

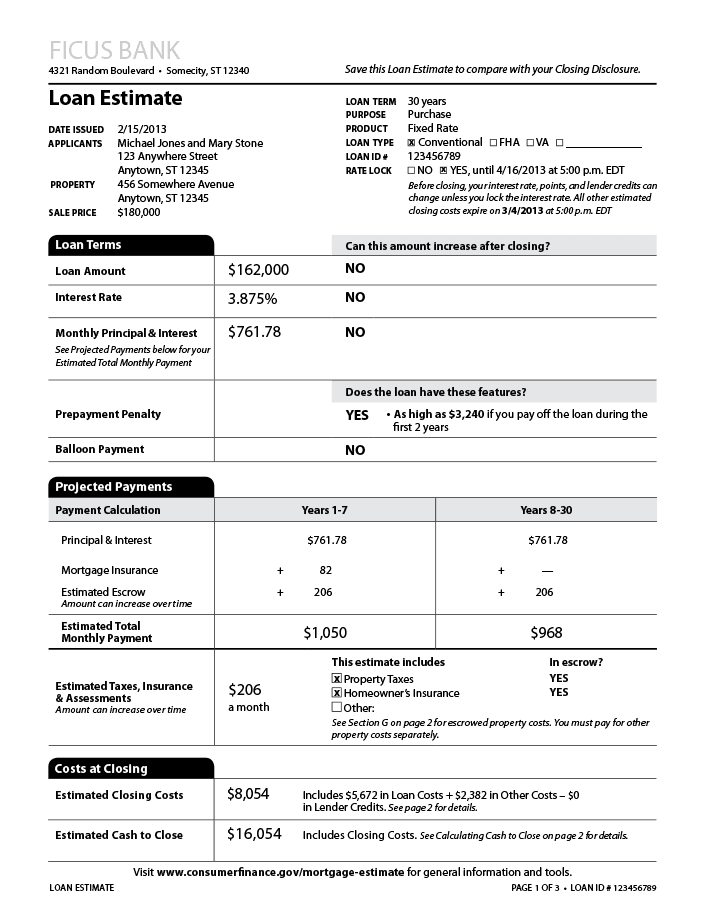

Loan Estimate Calculator House

Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Home affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending. Mortgage Loan & Refinance Calculator. Calculate home loan payments for Purchase or Refinance. Take the guesswork out of your mortgage payments. Use this. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. Our mortgage affordability calculator can give you an idea of your target purchase price. You can make the calculation based on your income or how much you'd. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Home affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Results shown are estimates only. Speak with a Chase Home Lending. Mortgage Loan & Refinance Calculator. Calculate home loan payments for Purchase or Refinance. Take the guesswork out of your mortgage payments. Use this. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. Our mortgage affordability calculator can give you an idea of your target purchase price. You can make the calculation based on your income or how much you'd. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate.

Mortgage Calculators. Our easy-to-use calculators will help you generate a mortgage estimate. View personalized scenarios to see what home loan may work best. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. A mortgage calculator that estimates monthly home loan payment, including taxes and insurance If you're thinking about buying a home, we can help you estimate. To calculate your DTI ratio, divide your ongoing monthly debt payments by your monthly income. As a general rule, to qualify for a mortgage, your DTI ratio. Enter your monthly income or the mortgage payment you can afford, plus expenses and interest rate, to get your estimate. Use our mortgage payment calculator to see how much your monthly payment could be. View estimated house payments on year fixed and other popular loan. Calculate your monthly USDA home loan payment to get a breakdown of estimated USDA mortgage fees, taxes, and insurance costs. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Try our free mortgage calculators to find out how much home you can afford, how much you could borrow and calculate your monthly loan payments with U.S. Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans Secure your property loan from. Use our free mortgage calculator to get an estimate of your monthly mortgage payments, including principal and interest, taxes and insurance, PMI, and HOA. Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. Loan amount Purchase price* Enter only numeric digits without. Selling a home. Home calculators. Mortgage calculatorDown payment calculatorHow much house can I afford calculatorClosing costs calculatorCost of living. Mortgage Calculator · Talk to a Home Buying Expert · Providing Low Rates is Our Highest Priority · We're here to help. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Mortgage: A long-term loan used to finance the purchase or refinancing of a property, typically repaid in monthly installments. Mortgage rate: The interest rate. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both. Estimate what your monthly VA loan payment could be, based on your home's purchase price, down payment amount, loan terms and interest rate. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Determine how much of your monthly income goes into your monthly mortgage payment. Finding the Right Home Loan.

Best Mortgage Companies In Dallas

Guild Mortgage is a top 10 lender with local loan officers in Dallas, TX and home financing plans to meet a wide range of needs. Find a mortgage loan. Whether you're a first time home buyer or have owned your home for 50+ years, you may ask yourself, "Who is the best Dallas mortgage lender near me?" Look no. Mylo Draven with Network Funding. He's helped me twice personally and I have a % success rate working with him. Best in Dallas 2 years running. Tatom Lending is a Dallas mortgage broker with an emphasis on educating, empowering, and protecting homeowners, home loan borrowers, and home buyers. Begin your journey to property ownership with Mutual of Omaha Mortgage, a trusted mortgage lender in Dallas, TX. Connect with us today for expertise! Big Life Home Loan Group has a solid reputation as the best of the mortgage companies in Dallas Texas to negotiate and follow through on the home lending. AsertaLoans is one of the 17 Best Mortgage Brokers in Dallas, TX. Hand picked by an independent editorial team and updated for South River Mortgage is the leading reverse mortgage company in Dallas, Texas. If you're interested in learning more about our reverse mortgage options in. U.S. News' Best Texas Mortgage Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans. Guild Mortgage is a top 10 lender with local loan officers in Dallas, TX and home financing plans to meet a wide range of needs. Find a mortgage loan. Whether you're a first time home buyer or have owned your home for 50+ years, you may ask yourself, "Who is the best Dallas mortgage lender near me?" Look no. Mylo Draven with Network Funding. He's helped me twice personally and I have a % success rate working with him. Best in Dallas 2 years running. Tatom Lending is a Dallas mortgage broker with an emphasis on educating, empowering, and protecting homeowners, home loan borrowers, and home buyers. Begin your journey to property ownership with Mutual of Omaha Mortgage, a trusted mortgage lender in Dallas, TX. Connect with us today for expertise! Big Life Home Loan Group has a solid reputation as the best of the mortgage companies in Dallas Texas to negotiate and follow through on the home lending. AsertaLoans is one of the 17 Best Mortgage Brokers in Dallas, TX. Hand picked by an independent editorial team and updated for South River Mortgage is the leading reverse mortgage company in Dallas, Texas. If you're interested in learning more about our reverse mortgage options in. U.S. News' Best Texas Mortgage Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans.

Dallas Reverse Mortgage Lenders At All Reverse Mortgage, Inc. (ARLO™), we take great pride in being recognized by the Better Business Bureau as the top-rated. Today's mortgage rates in Dallas, TX are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check. Our focus is to give the best rates with an easy process. Profile Picture. Meagan Barron. Providing services: Loans, Mortgage Lending. Dallas. Top 10 Best Reverse Mortgage in Dallas, TX - August - Yelp - Fairway Independent Mortgage, Jan McFarlane Reverse Mortgage Specialist, Elizabeth Rose. Search for Dallas, TX mortgage lenders and read thousands of customer reviews on the largest online directory of licensed lenders. Seeking the Best Mortgage Rates in Dallas Requires Diligence and Research Texas United Mortgage NMLS# | MORTGAGE BROKER ONLY, NOT A MORTGAGE LENDER. Mortgage Solutions Financial Dallas is the best home mortgage company for residents and investors in Dallas, Texas. Lone Star Financing – Your local Dallas mortgage company for new home loans and mortgage refinancing. Approved Texas FHA, VA, and USDA lender with low rates and. lender is crucial to securing favorable terms and a smooth loan process. Here are some tips for finding the best Dallas mortgage lender: Research and. Find a Dallas mortgage professional near you. Browse our directory for the best mortgage professionals and mortgage companies in the Dallas-Fort Worth area. Top 10 Best Mortgage Lenders Near Dallas, Texas - With Real Reviews · 1. Brent Hicks - The Hicks Group - Cardinal Financial Company · 2. The Raskin Team -. Looking for full-service mortgage lenders in Dallas, TX? Look no further than Mortgage Mark! Our team can't wait to help you on your home buying journey. Total Lending Concepts is the trusted mortgage lender in Dallas, TX. Offering a wide range of loan programs, including conventional, FHA, VA, and jumbo loans. Reliance Financial (Best Mortgage Lenders Texas). With our affordable rates and extensive knowledge of FHA, VA, Conventional, USDA, and Jumbo loan programs. Who are the best mortgage lenders for first-time buyers? A local Mortgage Banker (not your bank or. Supreme Lending Dallas · Voted TSAHC #1 Lender! · Supreme Lending Dallas Mortgage Reviews · Get Pre-Qualified with us Today. Are you in the market for a new home in Dallas? Do you want to work with the best mortgage lender in Dallas? Look no further; Capital Home Mortgage offers a. Supreme Lending is a full-service mortgage lender with a mission to create the best home financing experience possible. Learn more and contact us today. Explore top-rated Dallas mortgage companies for the best rates on home loans. Find trusted Dallas TX mortgage brokers, and loan providers. Book appointments on Facebook with Mortgage Brokers in Dallas, Texas.

What Does A Shingle Roof Cost

Roof Shingles(37 products) ; $And. 00 Cents ; (). $39And. 97 Cents ; (73). $62And. 46 Cents ; (29). $69And. 67 Cents ; $92And. 41 Cents. The cost of installing a new shingle roof is the highest, due to the labor and materials involved. Repair expenses can range from a few hundred dollars to. The basic cost to Install a Asphalt Shingle Roof is $ - $ per square foot in August , but can vary significantly with site conditions and. Asphalt shingle roofs cost between $5, and $20,, with an average cost of about $9, Asphalt shingles are lightweight, economical, easy to install, and. The average cost of a shingle roof on a 2,square-foot home with a seven-inch slope is $5, to $9, This price is for asphalt shingles. Other shingle. One square of 3 tab shingles costs about $ If you do the math, the shingles for an architectural roof replacement will cost $3, The shingles for a 3 tab. On average, it costs between $6, and $20, to replace a roof in Texas, with most homeowners spending around $12, to replace a 2, sq. ft. shingle roof. A square, standard-pitch roof with little complexity generally starts around $6, A square roof with the same pitch and complexity begins at around. Southwest Florida - $/sq all in (tear-off, labor, materials, replace) for shingle. Denver is about $ not long ago. Roof Shingles(37 products) ; $And. 00 Cents ; (). $39And. 97 Cents ; (73). $62And. 46 Cents ; (29). $69And. 67 Cents ; $92And. 41 Cents. The cost of installing a new shingle roof is the highest, due to the labor and materials involved. Repair expenses can range from a few hundred dollars to. The basic cost to Install a Asphalt Shingle Roof is $ - $ per square foot in August , but can vary significantly with site conditions and. Asphalt shingle roofs cost between $5, and $20,, with an average cost of about $9, Asphalt shingles are lightweight, economical, easy to install, and. The average cost of a shingle roof on a 2,square-foot home with a seven-inch slope is $5, to $9, This price is for asphalt shingles. Other shingle. One square of 3 tab shingles costs about $ If you do the math, the shingles for an architectural roof replacement will cost $3, The shingles for a 3 tab. On average, it costs between $6, and $20, to replace a roof in Texas, with most homeowners spending around $12, to replace a 2, sq. ft. shingle roof. A square, standard-pitch roof with little complexity generally starts around $6, A square roof with the same pitch and complexity begins at around. Southwest Florida - $/sq all in (tear-off, labor, materials, replace) for shingle. Denver is about $ not long ago.

Prices for asphalt shingles can vary based on quality and brand, ranging from $70 to $ per square foot. Consider the pros and cons carefully before deciding. How much does a new roof cost? · What is the average cost of a roof replacement? · In , the average roof replacement cost for an asphalt shingle roof was. For asphalt shingles, labor costs typically range from $ to $3 per square foot. More complex roofs or premium materials can push labor costs higher. 5. The average cost for a three-tab shingle roofing system is $2,, just for the materials. Fortunately, you've got loads of options when it comes to color and. New roof costs typically range from $15, to $27,, but many homeowners will pay around $21, on average. Pricing varies greatly depending on several. Shingle Roof. Most affordable · 5, - 19, · Most affordable roofing type. Lasts anywhere from years ; Metal Roof. Long lasting & affordable · 9, –. The average cost for a three-tab shingle roofing system is $2,, just for the materials. Fortunately, you've got loads of options when it comes to color and. Roofing Costs in Calgary ; Asphalt Shingles, $11,, $4, ; Metal Roof, $19,, $ ; New Roof Installation, $9,, $ ; Roofing Repair, $1,, $ The cost of installing a new shingle roof is the highest, due to the labor and materials involved. Repair expenses can range from a few hundred dollars to. The cost of a shingle roof can vary widely depending on several factors, including: On average, a roof replacement costs between $5, to $12, or more for. Roofing Calculator estimates that the average shingle repair costs around $ Cost to Replace Asphalt Three Tab Shingles. One of the biggest expenses in roof. What is the average cost per square foot to replace a roof in Ontario? · Basic Asphalt Shingle Roof: $–/sq ft · High-end Architectural. How much does a roof replacement cost? It will cost anywhere between $6, to $9, to replace a typical 1, square foot asphalt shingle roof. Roofing. On average, installing asphalt shingles on a new roof costs roughly $4 per square foot. The average roof in the U.S. measures 1, square feet, which is why. Asphalt shingle roofs cost between $5, and $20,, with an average cost of about $9, Asphalt shingles are lightweight, economical, easy to install, and. A typical price for a Roof Shingle is $52 but can range from approximately $ to $1, What are the most popular color/finish families of Roof Shingles? For asphalt shingles, labor costs typically range from $ to $3 per square foot. More complex roofs or premium materials can push labor costs higher. 5. Materials Used: A significant factor in the roof repair cost is the material that needs to be used. When repairing shingles, for example, asphalt shingles can. Average cost to install asphalt shingle roofing is about $ ( webnf.ru home, asphalt shingle roofing). Find here detailed information about asphalt. How Much Does a Shingle Roof Cost? A typical architectural shingle roof replacement will cost between $10, and $16, for a medium sized home.

Margin Account Thinkorswim

The cash for the initial margin requirement is automatically set aside in your account and subtracted from your buying power once an order is entered. Margin. The maximum leverage offered by thinkorswim is up to 50% for Margin Trading accounts. Margin trading allows users to borrow funds from the broker to increase. Day Trading Buying Power is given to margin accounts that have completed more than 3 day trades in a 5 rolling business day period, and have a start of day. Margin accounts are flagged as PDT when performing more than 3 day trades in a rolling 5-business day period. Accounts under $25, in equity will be set. Portfolio Margin is a method available for certain accounts for computing required margin for stock and option positions that is based on the risk of the. When an investor opens a margin account, they must make an initial deposit, called the “minimum margin.” The Financial Industry Regulatory Authority (FINRA). Portfolio margin offers a way to calculate a trader's margin requirements based on the overall risk of their portfolio and the trade. Current Charles Schwab Thinkorswim (TOS) brokerage trading account margin interest rates on loaned funds. Margin loans increase your level of market risk. · Your downside is not limited to the collateral value in your margin account. · Your brokerage firm may initiate. The cash for the initial margin requirement is automatically set aside in your account and subtracted from your buying power once an order is entered. Margin. The maximum leverage offered by thinkorswim is up to 50% for Margin Trading accounts. Margin trading allows users to borrow funds from the broker to increase. Day Trading Buying Power is given to margin accounts that have completed more than 3 day trades in a 5 rolling business day period, and have a start of day. Margin accounts are flagged as PDT when performing more than 3 day trades in a rolling 5-business day period. Accounts under $25, in equity will be set. Portfolio Margin is a method available for certain accounts for computing required margin for stock and option positions that is based on the risk of the. When an investor opens a margin account, they must make an initial deposit, called the “minimum margin.” The Financial Industry Regulatory Authority (FINRA). Portfolio margin offers a way to calculate a trader's margin requirements based on the overall risk of their portfolio and the trade. Current Charles Schwab Thinkorswim (TOS) brokerage trading account margin interest rates on loaned funds. Margin loans increase your level of market risk. · Your downside is not limited to the collateral value in your margin account. · Your brokerage firm may initiate.

Explore our full array of trading tools including the suite of thinkorswim® platforms. margin loan can be supported on the receiving brokerage account. For a. thinkorswim trading platform that's available for desktop, web, and mobile trading. “Margin Account and Interest Rates.” Charles Schwab. "Types of Accounts. A Reg-T (RT) call is issued when a margin account makes a transaction that exceeds its available buying power. Yes, you can. From what i know, account of more than USD$25K, there is no limit on your day-trading. Any account less than USD$25K. A margin account gives you the ability to borrow, using your stocks, bonds and cash as collateral. Selling short requires borrowing. First you. If you have a margin account you can trade with the proceeds as soon as you close a trade without worry. As long as your "Cash and Sweep". Pattern day trader rule or the PDT Rule – according to FINRA rules you need to have an account minimum of $25, for day trading stocks. TD AmeriTrade Margin. A quick way to determine if your account is on margin or borrowing cash is by referring to your settled cash balance. Spread trading must be done in a margin account. Multiple leg options strategies will involve multiple transaction costs. Covered calls limit the upside. Opening Multiple Brokerage Accounts · Each additional account you open gives you three more day trades per week · Commissions no longer act as a deterrent to. Cash and margin accounts are the two main types of brokerage accounts. · A cash account requires that all transactions be made with available cash. · A margin. Boost your buying power with a Margin Account. You can also get exclusive access to the thinkorswim platform. Open an account online today. Get started with margin in three simple steps. · Open a brokerage account · Apply for margin · Tap into available funds. A TD Margin Account allows investors to borrow funds to purchase securities, leveraging their investment potential. By utilizing margin, you can amplify. Trading on margin involves additional risks and complex rules, so it's critical that you understand the requirements and industry regulations before placing. Using the value of those assets, a margin account investor can borrow up to 50% of the amount of the cash needed to buy a stock or other security. The. In some margin trading accounts, the stock buying power can reach 4x the available cash in the account for intraday stock trading. As a result, traders can. It's because once you set up a margin account, your shares are eligible for someone else to borrow and short. If you read the full margin. For trading stocks and ETFs at US-regulated brokers, margin accounts need to have a minimum balance of $2, (also called “initial margin”) in cash before the. A margin account in Thinkorswim is designed to meet diverse needs, giving customers leverage of up to 50% depending on their plans, as per the rules of margin.